Pursuant to Section 81, subsection 2 of the Personal Income Tax Act 2011 as amended, the Kwara State Internal Revenue Service (KW-IRS) requires all employers of labour within Kwara State to file in their 2023 Annual Tax Returns not later than 31st January, 2024.

Kindly visit KW-IRS Self Service Portal on https://selfservice.kwirs.com to DOWNLOAD, FILL AND UPLOAD the completed Annual Tax Returns Forms.

Copies of completed forms could also be forwarded to helpdesk@kw-irs.com.

Documents required to be filed in include the following:

i. PAYE Annual Returns

ii. Remittance Summary

iii. Withholding Tax Annual Returns

iv. Nominal roll of the Organization

v. Scanned copies of approved monthly payroll, automated revenue receipts on PAYE, Withholding Tax and Development Levies.

vi. Expatriate quota and Immigration Returns of expatriate(s) (if applicable)

All employers of labour in the State are to note that failure to file in tax returns by close of business of 31st January, 2024 is a contravention of the provision of the Section 81, subsection 3 of the Personal Income Tax Act under reference and shall be liable on conviction to a penalty of N500, 000.00 in the case of a Corporate body and N50, 000.00 in the case of an Individual.

For further enquiries, kindly visit any of our offices in all the Local Government Areas across the State or visit our website on www.kw-irs.com or social media platforms- @kwirs on Instagram, @KwaraIRS on Facebook and X or call 07006959477.

Signed

Shade Omoniyi

Executive Chairman

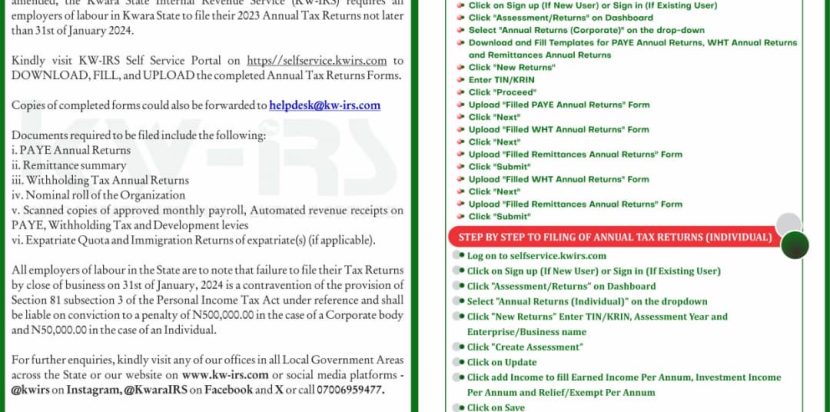

STEP BY STEP TO FILING ANNUAL TAX RETURNS

(CORPORATE)

✅Log on to selfservice.kwirs.com

✅Click on Sign up (If New User) or Sign in (If Existing User)

✅Click “Assessment/Returns” on Dashboard

✅Select “Annual Returns (Corporate)” on the drop-down

✅Download and Fill Templates for PAYE Annual Returns, WHT Annual Returns and Remittances Annual Returns

✅Click “New Returns”

✅Enter TIN/KRIN

✅Click “Proceed”

✅Upload “Filled PAYE Annual Returns” Form

✅Click “Next”

✅Upload “Filled WHT Annual Returns” Form

✅Click “Next”

✅Upload “Filled Remittances Annual Returns” Form

✅Click “Submit”