The Executive Chairman, Kwara State Internal Revenue Service (KW-IRS), Shade Omoniyi, alongside Management and staff of KW-IRS paid a courtesy visit to …

In a bid to further sensitize and synergize with agencies of government in Kwara, the Executive Chairman, Kwara State Internal Revenue Service …

The Management of Kwara State Internal Revenue Service (KW-IRS) has completed a 2-day strategic session organized to assess the success achieved in …

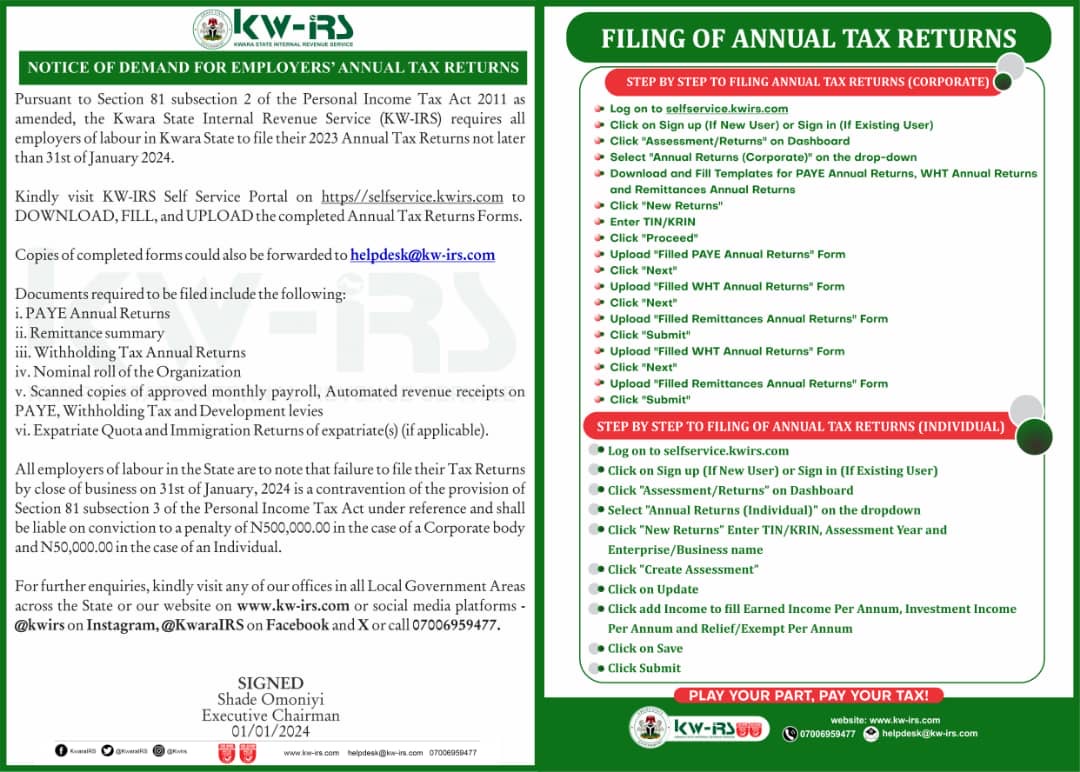

Pursuant to Section 81, subsection 2 of the Personal Income Tax Act 2011 as amended, the Kwara State Internal Revenue Service (KW-IRS) …

The Annual Kwara State Internal Revenue Service (KW-IRS) End of Year Sports Festival ended today Thursday, 14th December 2023 with Legal and …

The newly appointed Executive Chairman of Kwara State Geographic Information Service (KW-GIS), ESV. Abdulkareem Sulyman in company of the Acting Administrative Secretary …

The 2023 Tax Club Quiz Competition organized by Kwara State Internal Revenue Service (KW-IRS) for Secondary Schools in Kwara State in collaboration …

The Executive Chairman, Kwara State Internal Revenue Service (KW-IRS), Shade Omoniyi in company of some members of staff of the Service, paid …