The Kwara State Internal Revenue Service, KW-IRS, on Thursday, organized a One-Day Capacity Development Training for the Staff of the Revenue Department of the State’s Ministry of Justice.

The training held at KW-IRS, discussed the roles of the Kwara State Ministry of Justice in the administration of the General Principles of Taxation, Personal Income Tax, and Land Administration for Kwara State.

In her welcome address, the Executive Chairman, KW-IRS, Shade Omoniyi, who was represented by the Director, Legal and Compliance Directorate of the Service, Abdullahi Sheu Mogaji, called for both the Ministry of Justice and KW-IRS to collaborate more in ensuring effective and efficient Tax Administration finds its feet in the State.

The staff of KW-IRS took their turns to speak to various topics on taxation at the training.

Speaking to the laws as it relates to revenue generation, particularly as applied to the Nigerian States, such as laws for the creation of statutory bodies, ministries, agencies, parastatals, a staff of the Legal and Compliance Directorate of the Service, Mary Ibiwoye, noted that the role of the Revenue Department of the Ministry of Justice is basically to support KW-IRS in the enforcement of Tax defaulters to ensure total compliance in the State.

On the general principles of taxation, the Head, Monitoring and Evaluation Department, Bolakale Imam, further explained that equity, certainty, convenience, flexibility remain some of the major canons of taxation on which a good tax system are built, charging both the Service and Ministry of Justice to build a virile tax system for the State.

He added that for the Service to adequately carry out its mandate, full administrative autonomy needs to be given by the State government.

The Head, Tax Assessment Department, Sunday Agbana, in his submission, explained issues bordering on Pay As You Earn (PAYE), Direct Assessment, Filing of Tax Annual Returns, Validity of Assessment, Personal Income Tax (PIT) collection Procedures and Final and Conclusive Assessment.

“When we talk about Personal Income Tax, there are two collection methods of administration- PAYE and Direct Assessment. While PAYE is meant to administer personal Income Tax of people in paid employment, Direct Assessment is for Self-employed individuals/Ventures/Enterprises”, Agbana explained.

On the Kwara State Land Administration, Land Charge Laws, 2009 as amended, the Head, Property Tax at KW-IRS, Olanike Wole-Oke, also spoke on the roles of the Bureau of Lands in the assessment and generation of the Land Charge Bills.

She stated that the Constitution of the Federal Republic of Nigeria 1999, as amended, enables the Kwara State Government to consolidate all ground Rent Laws, Land related laws into a new land-based charge called Land Charge Law No. 7, 2009.

Corroborating the discourse on the land charge administration in the State, a Manager in the Property

Tax Department of the Service, Abayomi Ajiboso, took participants through the process of assessment and computation of land charge, adding that enumeration, uploading to the data bank, reconciliation of data, and calculation of Land Charge using the stator formula, form the process of land charge assessment.

The participants were exposed to the fact that Property Tax in Kwara State is taking a new dimension with the introduction of the Geographical Information Service, continuous improvement in automated processes, and system synchronization of relevant MDAs involved in landed property and Real Estate matters, noting that, the Ministry of Justice has a significant role to play in the generation of revenue for the State through more collaboration with the Service.

The participants lauded KW-IRS for the initiative and exposition to ways to enhancing IGR for the State, with a promise to put to use all learning points of the training.

Participants at the training include the staff of KW-IRS and the Ministry of Justice.

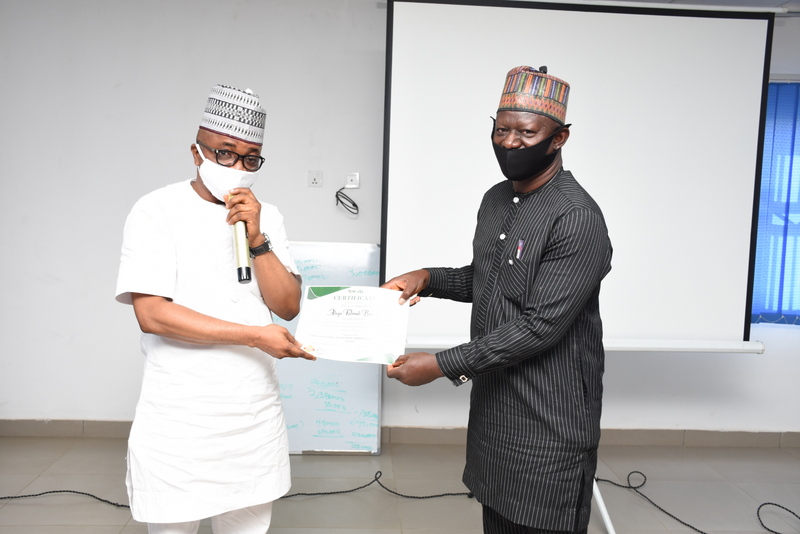

The training witnessed the presentation of certificates to all participants.

Signed

Corporate Affairs Department, KW-IRS

5/3/2021