The Directed Employers of Labour in Kwara State have been charged to faithfully discharge their responsibilities in ensuring correctness in the deduction and remittance of Pay-As-You-Earn (PAYE) and other statutory deductions to the coffers of the State government.

This was stated at the 2021 annual PAYE workshop organized by the Kwara State Internal Revenue Service, (KW-IRS), Tuesday, 25th of May, 2021 at the Kwara State Banquet Hall, Ilorin.

The annual event is geared towards exposing directed employers of labour to the required procedures to correct deductions of PAYE from salaries of their employees and other deductible taxes as provided by law and in compliance with the implementation of the 2020 Finance Act.

In her keynote address at the workshop, themed “Operation of PAYE Scheme and other statutory deductions”, the Executive Chairman, KW-IRS, Shade Omoniyi appreciated all organizations present for the continual mutual, beneficial and progressive relationship enjoyed over the years which have resulted in increased revenue generation for the State and requests more collaboration of all employers of labour in the drive of the strategic development of the Kwara.

The KW-IRS boss, further said that, the PAYE workshop is the first since she assumed office as the Executive Chairman as it could not hold last year for reason of Covid-19 pandemic and expressed her delight in the turn out of participants, reiterating that the workshop will not only afford participants at the workshop to share ideas on grey areas in taxation, but also serve as an opportunity to interact and cross fertilize ideas towards an improved service delivery.

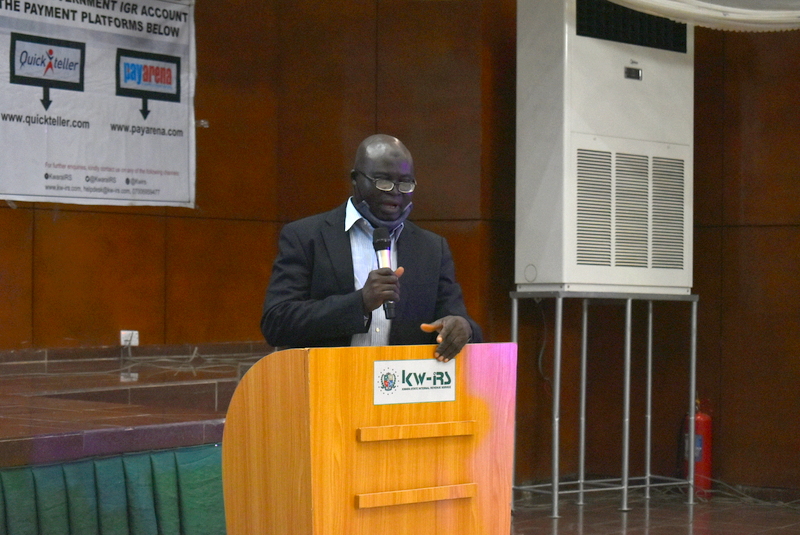

Delivering the first paper at the event, the Head, Tax Assessment, KW-IRS, Sunday Agbana, took participants through the implications of the Finance Act 2020, signed into law by the President of the Federal Republic of Nigeria, Muhammadu Buhari, on the 31 December, 2020 and effective 1st January 2021.

He analyzed the major amendments in the Finance Act, the roles of Stakeholders and Employers of Labour in PAYE implementation, Stages of Personal Income Tax computation, Offences and Penalties attached to defaults and procedures to collection of Tax Clearance Certificate (TCC).

In his presentation on the requirements of Annual Tax Returns and Back Duty, the Head, Tax Audit, Kabiru Rufai, explained that, Tax Audit is a tool to confirm the level of compliance of every Directed Employer of Labour to the directive of the tax law with regards to PAYE and other deductibles, such as water rate, development levy, withholding tax on contracts, bank interest, etc. He further charged directed employers of labour on need for submission of Nominal Roll and Annual Tax Return.

Taking participants through the frequently asked questions on PAYE, the Head, Corporate Department, Abdulahi Gegele, explained that PAYE is statutory and mandatory and non-remittance is punishable under the relevant laws, adding that Private Organizations, SMEs, FMDAs, SMDAs, LGAs, NGOs and Paramilitary, except Nigerian Police Force are all expected to remit PAYE as deducted to relevant Tax Authorities.

Remittance of PAYE is due every 10th day of the month, Gegele emphasized and the KW-IRS, through its automation system has made it easy to remit such and other taxes via any of its available Payment Solution Service Provider, (PSSP), Remita, Quickteller, Payarena, E-tranzact and KW-IRS customized POS.

The Head, Corporate Department, added the need for Tax Payers to always request receipts of all transactions as it will serve as evidence of payment and also part of requirements for filing annual tax returns. “The benefits of remitting PAYE as appropriate is avoidance of interest & penalty, prompt issuance of tax clearance certificate when needed and enhancement of corporate image of any organization or agency” Gegele stated.

Corroborating the need to pay all taxes due with ease and the use of the Self-Service platforms provided by the State, the Head, Process Improvement and Business Analysis for KW-IRS, Taofiq Alabi, said that, the KW-IRS automation is aimed at re-engineering the current tax processes towards improving taxpayers compliance, meet the standard of the tax solution in compliance with good practices, strengthen the State’s tax administration and respond effectively to the dynamics of the revenue challenges in the State.

Alabi pointed out that some of the innovations under the Abdulrahman Abdulrazaq led- administration include, the development of a tax solution implementation, business process re-engineering, multiple payment platforms, process automation and taxpayers’ database development.

In her closing remarks, the Ag. Director, Income Tax, who doubles as the Director Accounts and Finance, KW-IRS, Omolara Ojulari, appreciated all participants for their time and unwavering support in ensuring the needful are carried out as it relate to correct deductions and remittances of taxes and in collaborating in the growth of IGR of the State.

The workshop had in attendance Director Admin and Operations, Olatunji Balogun, Director, Legal and Compliance, Shehu Mogaji Abdullahi, Esq. staff of the Service and over 400 representatives from various organizations and agencies across the State.

Signed

Corporate Affairs Department, KW-IRS

25th May, 2021.

#PayeWorkshop2021

#StateOfHarmony

#ForABetterKwara

#PlayYourPart