KW-IRS ORGANIZES TAX EDUCATION WORKSHOP FOR EMPLOYERS OF LABOUR IN KWARA STATE

KW-IRS TRAINS STAFF ON TAX AUDIT AND PROPOSED TAX REFORMS

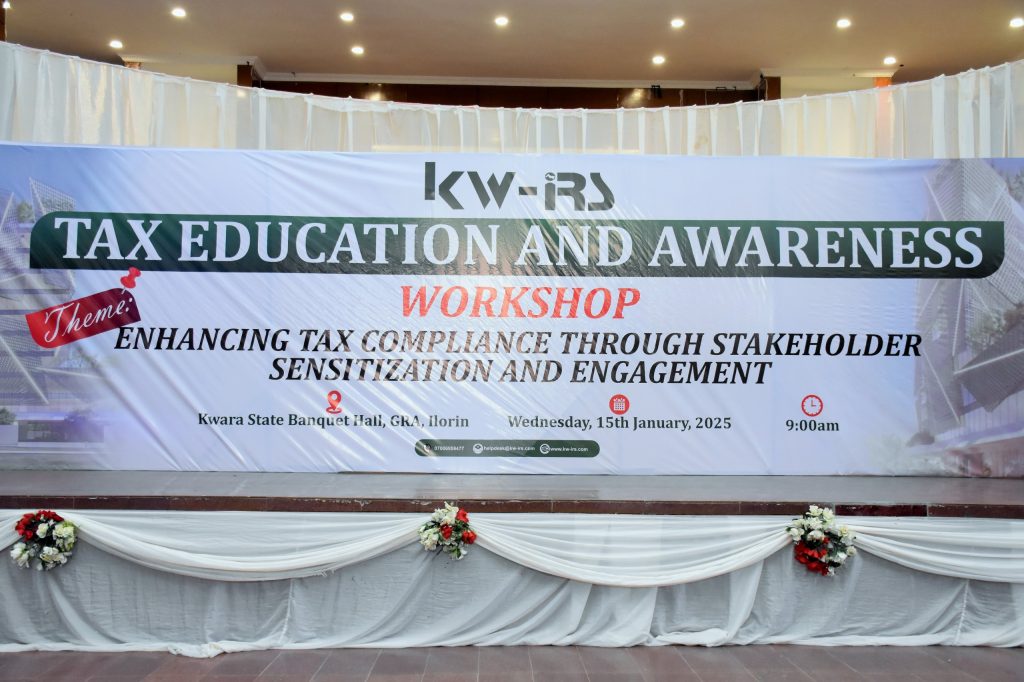

December 11, 2024In line with its commitment to ensuring continuous taxpayer sensitization, the Kwara State Internal Revenue Service (KW-IRS) organized a Tax Education and Awareness Workshop for employers of labour in the State on Wednesday, 15th January 2025, at the Kwara State Banquet Hall, Ilorin.

The workshop themed “Enhancing Tax Compliance through Stakeholder Sensitization and Engagement,” served as a vital platform for bringing together designated employers, offering essential insights on filing of annual tax returns and streamlining tax payment processes.

Delivering her keynote address at the workshop, the Executive Chairman, KW-IRS, Shade Omoniyi, emphasized the critical role of taxation in driving economic development; describing it as the foundation for financing essential public services such as infrastructure, education, and healthcare.

While acknowledging persistent challenges associated with tax compliance in the State, the KW-IRS boss outlined the need for collaborative strategies and active stakeholder engagement to foster a transparent and efficient tax system. She highlighted issues bordering on the KW-IRS harmonized bill, implications of non-compliance, and the 2024 Withholding Tax Regulations alongside the proposed tax reforms in Nigeria, and urged participants to embrace voluntary compliance, register unlisted businesses, file tax returns promptly, declare all income sources, and adhere to payment deadlines.

The workshop featured five paper presentations from staff of KW-IRS on topics relating to tax compliance. In his presentation, the Director, MDAs, Omotayo Ayinla, highlighted the importance of the harmonized bill which consolidates the multiple tax types collectible by the Service into a single document, ensuring clarity, and simplifying the taxation process for both taxpayers and the tax authority.

Muhammed Audu emphasized that filing Annual Returns is mandatory, and non-remittance of taxes is punishable under relevant laws. He further explained that non-compliance attracts serious consequences, including legal penalties, financial losses, reputational damage, and potential operational disruptions.

During his presentation, Mohammed Kabiru Rufai provided a practical guide on filing annual returns for both corporate organizations and individuals, using the KW-IRS Self Service Portal. Participants were allowed to file their annual returns following the step-by-step guide provided, and prizes were won by those who were able to submit their returns on the spot. Rufai underscored the importance of submitting employees’ nominal roll and annual tax returns by employers to ensure accurate reconciliation of remittances for each organization.

Kuburat Yinusa made an extensive presentation on payment options and platforms provided by the Service. She raised awareness on the seamlessness of tax payments through the Self-Service Portal, highlighting it as a key component of the State’s automation goals.

Abdullahi Gegele, in his presentation on Withholding Tax Regulations and the Proposed Tax Reforms, highlighted key aspects of the new tax reforms, including streamlined processes, improved taxpayer database, and stricter compliance requirements. He stated that these reforms aim to promote efficiency, transparency, and convenience for both individuals and organizations.

The workshop addressed frequently asked questions about the harmonized bill, annual returns filing, and the proposed tax reforms.

Wrapping up the event, the KW-IRS Director, Income Tax, Mohammed Usman, expressed appreciation to participants for their time and support in ensuring tax compliance and contributing to the growth of Internally Generated Revenue (IGR) in the State.

The workshop had in attendance management and staff of KW-IRS and representatives from various organizations across the State.

Signed

Corporate Affairs Department, KW-IRS

16th January, 2025