April 26, 2024

The Executive Chairman, Kwara State Internal Revenue Service (KW-IRS), Shade Omoniyi, HCIB, ACTI, was the Special Guest of Honour at the 50th Induction Ceremony of the […]

April 25, 2024

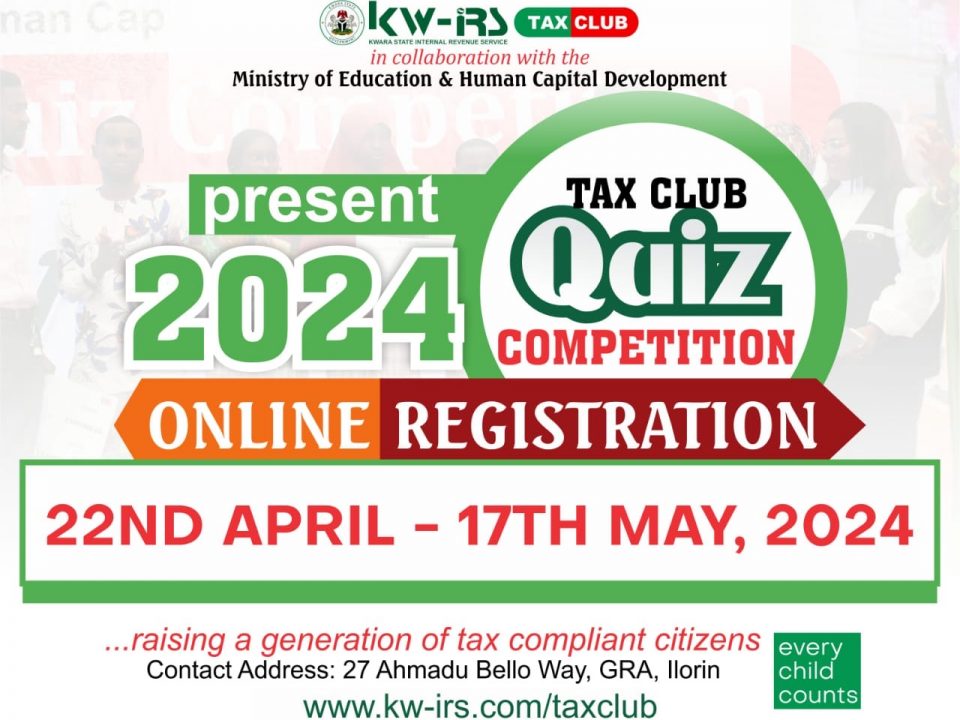

April 22, 2024

The Kwara State Internal Revenue Service (KW-IRS) notifies the general public of the commencement of registration for the 2024 Tax Club Quiz Competition for Secondary Schools […]

March 21, 2024

The Executive Chairman, Kwara State Internal Revenue Service (KW-IRS), Shade Omoniyi, received the Sector Commander of the Federal Road Safety Corps (FRSC), Kwara State Command, S.E. […]

March 21, 2024

The Executive Chairman, Kwara State Internal Revenue Service (KW-IRS) Shade Omoniyi received members of the Nigeria Institute of Public Relations (NIPR) at the Corporate Head Office […]

March 11, 2024

The Kwara State Internal Revenue Service (KW-IRS) assures taxpayers in the State of its commitment to seamless discharge of its mandate. The Service will continue to […]

March 8, 2024

The Joint Tax Board (JTB) presented a Long Service Award to the Executive Chairman, Kwara State Internal Revenue Service (KW-IRS), Shade Omoniyi on Tuesday 5th March […]

March 1, 2024

As part of efforts to ensure tax compliance by residents and business owners in Kwara State, Kwara State Internal Revenue Service (KW-IRS), today Friday, 1st March, […]

February 27, 2024